I’m not supposed to be blogging. Philippe and I have a book deadline at SUP this week. We have a Forbes piece due soon, too. And I have a speech to prepare for an Institutional Investor Forum in mid-September. So I’m going to make this quick…

Tonight I went out for dinner with a stack of reading to catch up on. Over indifferent Italian, I read two articles that I have to share. One I want to share because it’s so smart, and the other I want to share because it’s the opposite, but it parrots several popular misconceptions.

Let’s start with the smart article, “The Folly of Energy Independence” from the latest issue of The American Interest. If you invest your own or (especially) other peoples’ money, enjoy thinking about the future, or are simply a “concerned citizen”, read it. The authors Gal Luft and Anne Korin offer a brilliant and overdue inoculation against a lot of popular and faux-sophisticated reporting about resources, energy and world oil market. They understand the role of prices, incentives, and the structure of commodity markets. Best of all, with that understanding in mind they conclude the article with a workable suggestion for managing our future energy needs. I finished it (and my first course) ready for more.

Unfortunately, Luft and Korin’s piece fortified me to consume the latest Jeremy Grantham GMO Quarterly Letter alongside my main course. I’d printed it a few weeks ago, but the title put me off. It’s called “Welcome to Dystopia! Entering a long-term and politically dangerous food crisis”. It turned out to be so bad that it’s instructive, so I decided to come home, walk our pug Pesto, and write this post.

To learn the most from the July GMO Quarterly Letter, here’s what I suggest: download it here. Print it out. Then, as you read it, ask yourself after each paragraph, “But why won’t the price mechanism work?” Over its 17 pages, you’ll find yourself repeating that question over, and over…and over.

The neo-Malthusian extrapolation in doom-laden pieces like “Welcome to Dystopia” never ceases to amaze me (I sometimes think such articles can be best understood by applying psychology rather than economics. Most – including Grantham’s latest – could be productively revised through the author asking themselves the simple question: “Why is the lamp by which I am writing this not lit by whale oil?”). Fund managers can indeed generate “geopolitical alpha”, but not with sloppy thinking like this.

For starters, Grantham has never heard the warning of a former a British Chancellor of the Exchequer, “Beware of extrapolation: it can make you go blind” (even though he quotes Kenneth Boulding to the same effect at the start of the article). Again and again, Grantham holds one item constant, and draws a straight line to chaos, doom, starvation and war.

Like many business leaders today, Grantham is also not afraid to release his Inner Authoritarian, writing that the only people who seem to understand what is going to happen to future commodity prices (Up! Up! Up!) and the world economy (Down! Down! Down! – though how that squares with Up! Up! Up! is not explained), are the Chinese Government and the military forces of the US and UK. I know that fear sells, and this is an investment newsletter, but Wow! – for a man who’s made millions, Grantham sure lacks faith in the price mechanism. (Grantham also fails to recognize the limits of developmental autocracy in China, but he’s hardly alone there).

Truly, “Welcome to Dystopia” is a catalog of self-contradiction and error. Like many “The world is running out of X” pieces, Grantham cites Leading Authorities about dwindling supplies of various essential commodities, and paints dire straight lines between present trends and doom. He fails to explain convincingly, however, why this time innovation, spurred by price, won’t drive substitutes and solutions. Hasn’t he heard of the Simon and Ehrlich bet? Oh. I forgot: “This time is different”. I suppose he gives fair warning by using the terms “paradigm shift” and “phase change” right off the bat.

As close friend pointed out to me a few years ago, “When you buy commodities, you’re selling human ingenuity.” I may not be as wildly optimistic as some, but I certainly don’t think Grantham makes a persuasive – or even logically consistent – case for a coming commodity dystopia.

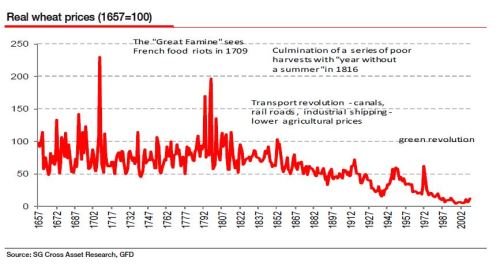

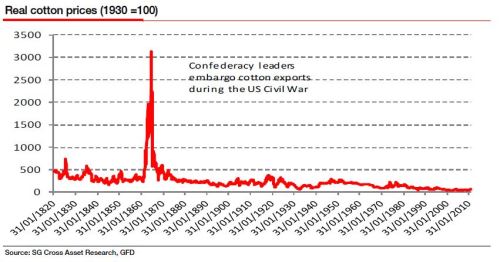

Not convinced? I hope to expand more on this theme in later posts. Tonight, I have to head to bed. In the meantime, however, consider the SocGen charts below…

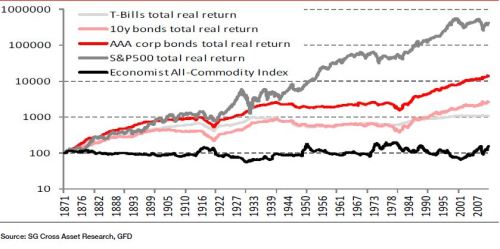

And finally, for those “Investors” in commodities out there (I don’t doubt that some speculators make money in commodities)…

In sum, the trend in the real cost of commodities over time is clear. What is also clear is that when prices are allowed to work, the cure for high prices is high prices (unless you’re in the cartel situation that Luft and Korin describe).

PS Mr. Grantham – if by chance you read this, and would like to re-run the Simon and Ehrlich bet together, I’d be happy to do so: 10 years, a basket of any five commodities, for $1000.00. If they’re higher in real terms on 30 August, 2022, I’ll happily pay up to the charity of your choice.

If you enjoyed this post, please subscribe to our blog. Thanks!

Thank you Milo! Great article! If you find the time would you please copy this also to my blog on blogspot (“Towards a Knowledge-based Economy”) ? Thank you and best wishes, Christopher

Amazing. It’s so simple: substitution and solution. Politicians fail to trust economic mechanisms they should advocate. But fear sells, anyway.

Excellent article Milo, thank you. If the price is high enough, innovation kicks in.

Pingback: Geopolitics and Investing: A Reading List « Silberzahn & Jones