On March 21, Milo will offer an IE Masterclass on “Geopolitics for Business” in Tokyo. The following day, he will be speaking on the same topic at Nissan’s Global Headquarters and in a Nikkei Open Seminar. Please contact him if you would like to attend one of these sessions.

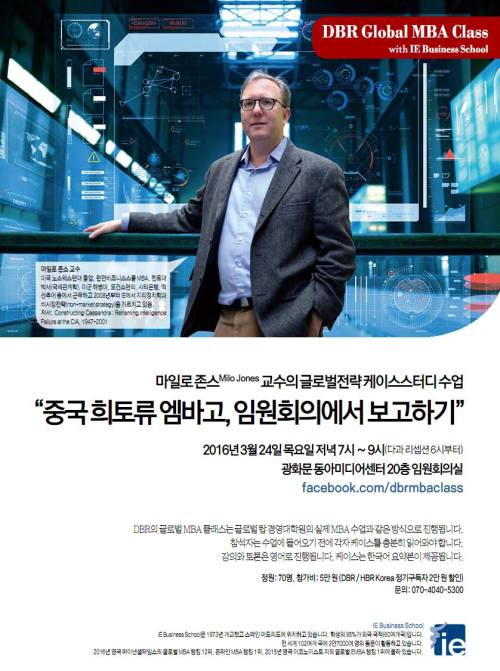

In Seoul on March 24, Milo will offer a session on the promise and pitfalls of Big Data at Ernst & Young. That session will be followed in the evening by a special, two-part Masterclass for Harvard Business Review Korea (Donga Business Review) entitled “Intelligence Tools for the Business Professional”. In this session, Milo will explore how businesses can use analytic tools drawn from the Intelligence Community to understand incidents like the de facto 2010 Chinese embargo on the export of rare earth elements. Please note that this event hosted by DBR on a fee basis; if you are interested in attending, please register here.

The content of all of these sessions will be covered in much greater depth in Madrid in June, when Milo is co-teaching the three-day IE Executive Education course “Unconventional Edges in Finance: Tools from Intelligence Agencies, Behavioral Finance, and Scenario Strategy.” Details about the course and how to register for it can be found here.

On Wednesday, December 9, Milo is speaking on the panel “Qatar’s Strategy in a Changing World” at the

On Wednesday, December 9, Milo is speaking on the panel “Qatar’s Strategy in a Changing World” at the