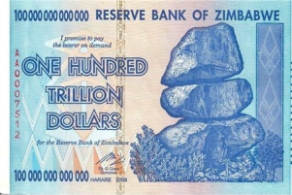

The goal of strategy is to decide what to do in a given situation to achieve a given objective. Basically, strategic decisions comes down to the question “what to do next?”. In environments characterized by uncertainty (defined as objective lack of information), this is no simple question, and several approaches are possible to address it. Two dimensions characterize these possible approaches: prediction and control.

Prediction asks to what extent does my approach rely on a forecast of the future environment. Strong prediction corresponds to either a planning-type approach – I create a detailed prediction of the future before initiating action – or a vision type: I imagine the future and I strive to make this vision a reality. Low prediction corresponds to a more adaptive approach: I do not try to predict the future environment, but instead I move on and I adapt to changes along the way.

Control asks how I can control the evolution of my environment. The over-arching assumption of classic strategy is that the firm has little influence on its environment, which is for the most part given (or “exogenous”). All a firm can do is to find a place in this environment (planning /positioning) or adapt when it changes (adaptation). Hence the importance of the notion of “fit” that the field insists upon (e.g. Michael Porter in 1996). On the opposite side of the spectrum, the field of entrepreneurship observes that a firm can change its environment in profound ways, sometimes from an ex ante defined vision, or through the logic of future-agnostic gradual transformation of the environment. There are many examples of entrepreneurs starting with odds apparently stacked against them and completely transforming their environments: Michael Dell, Richard Branson, Sam Walton, to name just a few.